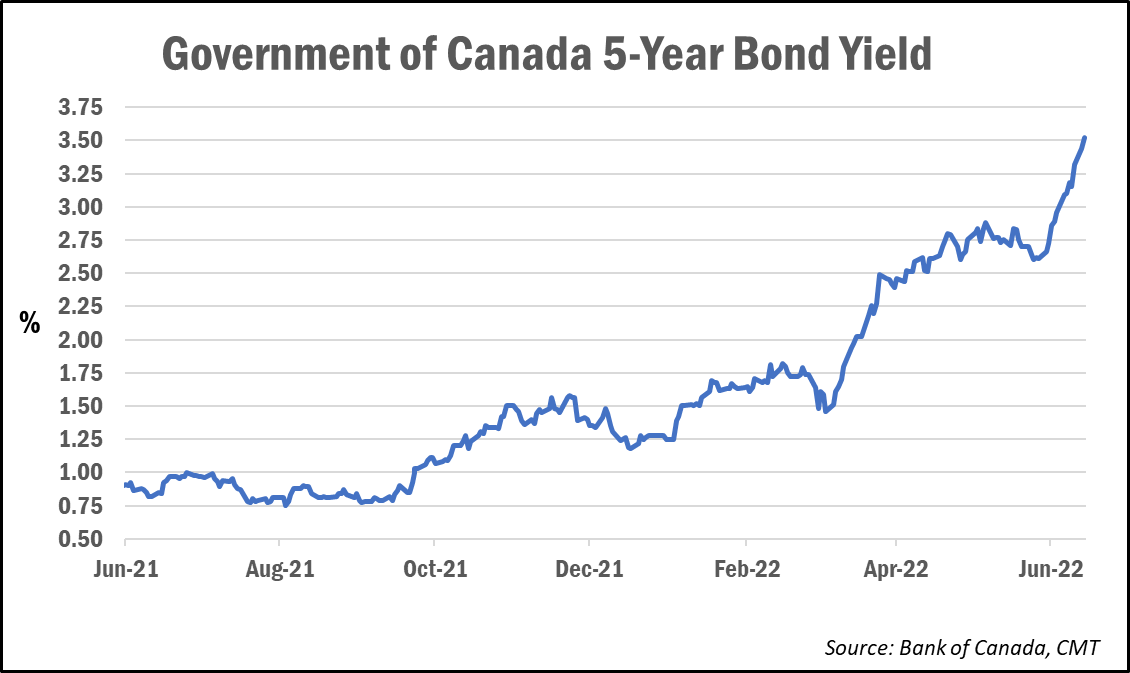

Bond yields surged to a fresh 14-year high this week, driving expectations that fixed rates are likely to continue rising.

As we reported last week, the Government of Canada 5-year bond yield was already on its way up, crossing the 3.20% threshold. Well, on Monday it broke the 3.51% barrier.

This is important because the 5-year bond yield is the best indicator for future moves in 5-year fixed mortgage rates.

Fixed mortgage rates have already been trending higher, with discounted, nationally available rates reaching an average of 4.80% for uninsured mortgages (those requiring a minimum down payment of 20%), while average insured rates have risen to an average of 4.57%, according to data tracked by Rob McLister, rate analyst and editor of MortgageLogic.news.

With bond yields up 20 basis points from Friday, borrowers should expect that 5-year fixed rates “will likely rise again this week,” noted Integrated Mortgage Planners broker Dave Larock, in his latest blog post. “This next round of increases will push five-year fixed rates offered by most lenders above 5% (about double where they were at the start of this year).”

a,” accounting for more than 22% of sales in 2021, compared to 19% in 2019.

“They also extracted increasing amounts of equity out of their appreciating investments to, yep, buy more homes,” the report reads. “This group will be the first to pull back, and if they start selling en masse, the price correction could gain steam.”

Recent Comments